Rapid Investments, LLC is majority owned and directed by two seasoned entrepreneurs Dan Summers and Evan Lang

Dan is a co-founding partner and major shareholder at Rapid Investments. At Rapid, Dan is responsible for raising capital to support the growth of the portfolio companies and working to identify new investment opportunities. Over the course of Dan’s career, he has sourced over $100 Million in capital. He has over 17 years of leasing experience and 14 years of executive management experience. On a day-to-day basis, Dan serves as a Managing Director at Rapid’s three portfolio companies, Go Capital, Nations First Capital and TopMark Funding. He is responsible for providing corporate strategy and for directing the leadership teams. Dan enjoys spending time with family and friends, traveling and a good adventure.

Background:

Dan grew up in Seattle, Washington and attended Franklin High School where he was enrolled in the Academy of Finance. Dan gained his initial exposure to finance while working in a summer internship at Smith Barney (now Morgan Stanley) and subsequently decided to enroll in business school. Dan graduated in 2001 from Babson College in Wellesley, Massachusetts with a B.A. in Business Administration where his studies focused on Finance and Entrepreneurship. After graduation Dan moved to California and started his career in commercial finance with Balboa Capital. There he served in sales, accounting, and finance roles. Following Balboa Capital Dan worked with Rapid Investments co-founder, Evan Lang, on the Executive team of Nationwide Funding for 4 years as the company’s Chief Financial Officer and Chief Operating Officer and was responsible for helping the company scale and successfully exit to a competitor.

After the sale of Nationwide Funding to American Capital Group, Dan went on to serve for 4 years as the Chief Financial Officer of EagleRider Motorcycles, the world’s largest motorcycle experience company specializing in Harley-Davidson, Indian, BMW, Honda and Triumph motorcycle tours, rental, sales and service. As a core member of the leadership team, Dan worked to help position EagleRider for additional growth. EagleRider was subsequently purchased by Main Post Partners, a Private Equity Firm, whose investment in EagleRider has helped the company pursue continued expansion. In 2012 Dan founded IEG Money, an equipment finance company specializing in financing Commercial Semi-Trucks and Trailers. In 2013 Dan and Evan reunited and co-founded Rapid Investments, purchasing the assets of IEG Money and rebranding the company as Go Capital. Go Capital became Rapid Investments first portfolio company. Between 2013 and 2017, Go Capital successfully carved out a niche and scaled its first portfolio to $100 Million in Lease Receivable with annual revenues exceeding $25 Million. Go Capital’s second portfolio, GC2, was started in 2019 and is supported by Rapid Fund I, LLC and is where Go Capital’s current growth is focused. In 2015 Go Capital spun off TopMark Funding, LLC which is an equipment lease brokerage. TopMark has grown rapidly and is currently pacing at $10 Million in annual revenue. TopMark has become the firm’s second largest core holding. In 2018 Rapid restructured Nations First Capital, LLC into a portfolio servicing company to collect on assets sourced by Topmark and owned by Go Capital.

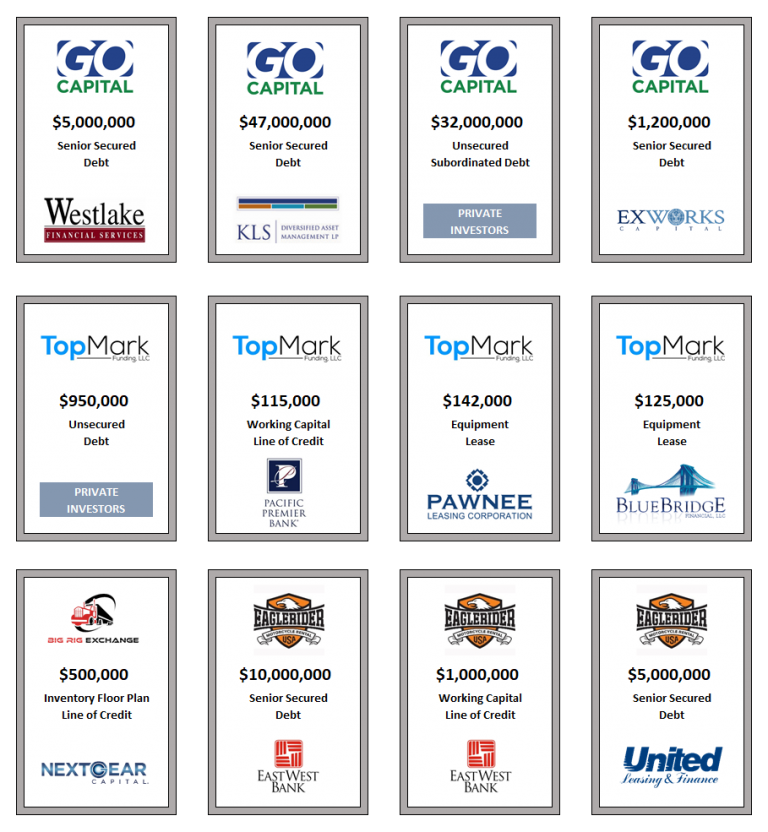

Over the course of Dan’s career, he has sourced over $100 Million in capital.

Open Transactions:

Completed Transactions: